ONESOURCE Trusts

Tax compliance you can trust

Save time and reduce the complexity of managing large volumes of entities with an automated trusts tax solution.

Simplify, streamline and drive workflow efficiency with trust tax software.

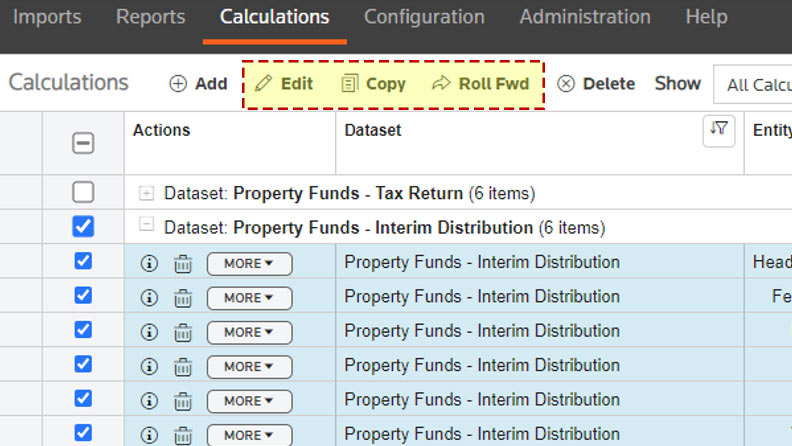

Automate processes, deliver faster

Reliance on inbuilt tax calculation designed specifically for managed funds and property trusts allows you to confidently streamline processes. Save time and deliver better with one step roll forward, bulk handling and so much more.

Book my demo

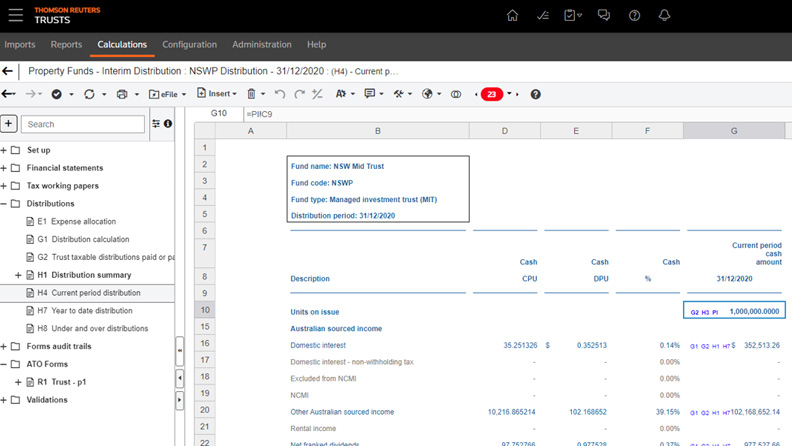

Gain insights, deliver more

Better plan and provide business insight with forecasting and “what-if” scenario capabilities. Extract tax data with ease and analyse using inbuilt managed fund tax data standards.

Book my demo

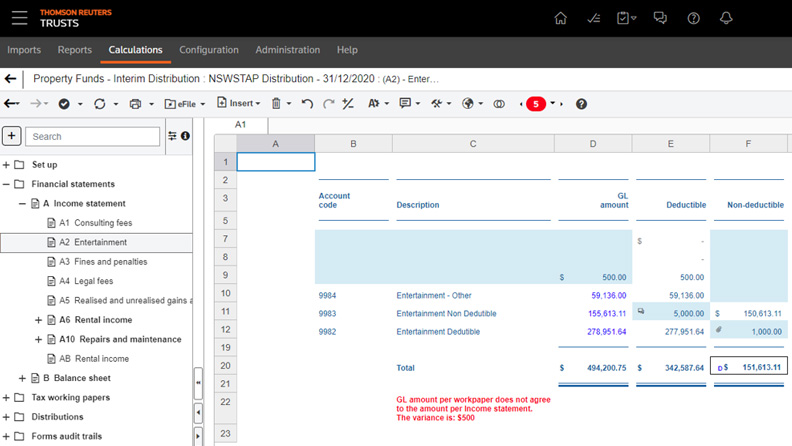

Increase control, deliver transparently

Multiple worksheets and manual calculations are a thing of the past. Inbuilt controls, integrity checks, comprehensive audit trails, allow you to identify potential errors, add comments and attach supporting evidence - all in one place.

Book my demo

The value of a trust tax compliance solution

Content you can trust

The latest tax reform content updated and maintained by our trust tax experts.

ATO certified, SBR enabled

Compliance with the ATO’s standard business reporting (SBR).

Intelligent inter-funding automation

The only tax solution in market capable of automating the flow of distributions between trust structures.

Powerful connectivity

API connectivity with existing systems, including unit registries and ERP software.

Greater agility

Web-based platform that enables your staff to work flexibly and securely, accessing calculation data anytime, anywhere.

Local support

Australian based support team to help you deliver on your tax compliance obligations.